February 16, 2022

We wrap up our latest sports betting series with Navigate by discussing our key takeaways and addressing some of the questions that friends in the industry asked us – hosted by Navigate’s Kayla Ketring and alacria’s Luke Bould.

Read More

February 3, 2022

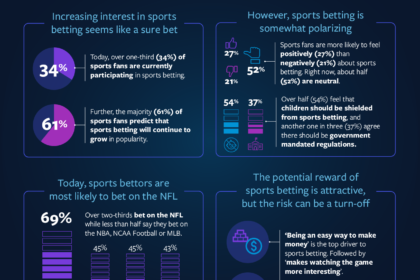

3 February 2022 As we wrap up our series on sports betting, we’ve highlighted the top takeaways. Sentiment on Sports Betting In our study, we found that sentiment around sports betting is largely neutral. Meaning that now is a pivotal time to form and shape sentiment among those who currently feel neutral about sports betting through media, messages, and marketing. As stated in part two of our series, ‘With careful management, positive sentiment may continue to grow because 61% of sports fans agree that they think sports betting will continue to grow in popularity.’ However, this would make the United States the exception to what has been experienced in other markets such as Australia, where sentiment became more negative over time, and that decline in sentiment has led to increased government regulation. Regulation has also been a driver of industry consolidation, with smaller players either exiting or being bought by larger companies because of the increased regulation making their businesses uncompetitive. Key takeaway: It is imperative to continuously monitor sentiment and proactively address any negative dips to ensure sustainable growth. Sports Betting Advertising Through our research, observations, and first-hand experience in other overseas markets, we’ve seen a significant increase...

Read More

January 25, 2022

25 January 2022 In part 2 of our series on US sports betting, we shared sentiment and behavior among the ‘average sports fan’. In part 3, we expand on who the Current Sports Bettor is, what the Future Sports Bettor may look like and what this means for sports and betting agencies. Current and Future Sports Bettors are largely similar in terms of attitudes and drivers / barriers towards sports betting. A key difference between the two groups is sports fandom – Current Sports Bettors are more likely than Future Sports Bettors to be avid sports fans, attend sporting events, and watch sporting events. However, the general pattern for the most popular sports and viewership tend to look similar to those of Current Sports Bettors, just on a lesser scale. (As a reminder, to qualify for the study you did have to be at least a ‘casual’ fan of one sport). Both groups are bullish on the future / benefits of sports betting – 73% of Current and 70% of Future Sports Bettors think sports betting will continue to grow in popularity. These percentages are especially high for male bettors. Two-thirds of Current Sports Bettors and 71% of Future Sports...

Read More

January 18, 2022

18 January 2022 Part 2 of our 3-part series uncovers sports fans’ behaviors, sentiment towards sports betting, and how those sports fans who currently participate in sports betting (‘Current Sports Bettors’) differ. Maybe not surprisingly, Current Sports Bettors tend to be more avid sports fans across all major sports asked about. As time goes on, it will be interesting to see if high fan avidity leads to the propensity to bet or the opposite – you become a more avid fan of the sports you bet on. Maybe a mix of both. Today, sports betting is somewhat polarizing – while only 21% feel negatively, slightly more (27%) feel positively. There is still a large contingent (52%) who feel neutral. With careful management, positive sentiment may continue to grow because 61% of sports fans agree that they think sports betting will continue to grow in popularity; however, this would make the U.S. the exception to what has been experienced in other markets. In the future, it’s expected that the percent of sports fans (fairly high at 52%) who are neutral about betting will take a stance, assuming their state legalizes sports betting. In terms of legalization, 22% of sports fans...

Read More

January 12, 2022

12 January 2022 alacria teamed up with Navigate, and data collection partner RepData, to release a new sports gambling study designed to help the US sports industry “peek around the corner” of sports betting. Together, we surveyed more than 1,000 American sports fans over the age of 21 who are current sports bettors (CSB) and/or future sports bettors (FSB) to gauge: – Sentiment and behaviors around sports betting, and how it evolves over time – Perceptions, drivers, and barriers to sports betting among sports fans in the U.S. Part 1 of our 3-part series sets the foundation for the legalization of sports betting in the United States. It is legal to bet on sports in 40% of states, and 29% of states are in the process of approving the rules for betting. We found that few Americans oppose the legalization of sports betting in the U.S, with over half saying legalization would not impact their likelihood to participate in sports betting, and over 20% saying legalization would make them more likely to participate. This is especially true for male sports fans, who are more likely to participate if legal. The landscape is changing quickly, so we thought it would...

Read More

August 12, 2021

As sports march on after a challenging 2020, there is a lot of optimism across the industry as the COVID year forced teams and brands to find creative ways to engage fans beyond physical experiences. One major method of engagement that has proven to be extremely lucrative is sports betting. For perspective, according to a report from Eilers & Krejcik Gaming, sports betting revenue is up 360% YTD as 56% of the population resides in a state where sports betting is now legal. While total revenue sits at around $2.5B per year, experts estimate that could increase to $10B by 2025 and potentially $19B if legalized in all 50 states. Sports betting is far from a typical consumer industry, nor is its relationship to sport one that can be considered traditional in terms of sponsorship. As we’ve all seen, the industry has had to overcome many statutory, ethical and integrity-related hurdles to get to this point. It will likely face many more as sentiment toward the role betting plays within sport shifts over time. According to data from GWI, 7.6% of sports fans in Pennsylvania, where sports betting is legal, believe that it’s a big issue in society, while only...

Read More

August 7, 2021

Kevin McCullagh Luke Bould discusses developments in the Australian market. Competition for rights has increased due to new sports streaming platforms. No rights fee boom yet, with some properties instead avoiding large decreases. Upcoming sales of big domestic properties will test new players’ appetites. An outbreak of ‘streaming wars’ in Australia has injected life into a sports media rights market that this time last year looked threatened by a sharp decline. Rights competition has been spurred in the last six months by the launches of new platforms Paramount+ and Stan Sport. There has been surprise competition from formerly niche player Sports Flick and a long-awaited first deal for Amazon. Established players, including Foxtel and Optus Sports, have moved to protect their positions with new rights deals. These developments have helped the market bounce back from a series of renegotiations last year. In the teeth of the pandemic, Australia’s biggest rights-holders accepted falling or flat fees in return for the security of long-term deals. However, few are predicting a rights-fee boom. Australia’s broadcasters have been battered in recent years by the shift of audiences to digital platforms and the pandemic. The new competition has so far mostly helped rights-holders stave off big falls in...

Read More

March 27, 2021

John Stensholt 11:35AM March 26, 2021 Australian sports need to be careful not to cut costs too much or risk losing market share, according to former soccer and rugby league boss David Gallop, who says the days of taking a “scattergun” approach to communicating with fans and members also has to end. Gallop says he has been impressed with the resilience of many Australian sports during COVID-19, but warns with corporate budgets tight and broadcast revenue likely falling sports need to look for a better way to monetise their relationship with fans and members to shore up their revenues. That, Gallop says, needs to come from having a better understanding of fans and paying members, what they will spend money on and how they will engage with the sports. Like Amazon, the global retail giant that has a deep understanding of its customers and tailors the sale and products to their members digitally, sports need to take a more individual approach. “Sports have tended to still take a bit of scattergun approach to communication. Every member gets an email and so on. They need to be looking at a more personalised approach and the technology for that,” Gallop tells The...

Read More

March 26, 2021

The past year has created an environment that sport has never faced before, and the need for a new, radical approach to the industry. Alacria has been working with sports across multiple markets to rethink the present and prepare for the future opportunities of 2021 and beyond. To drive this growth and offer our clients the best strategic advice available, we are delighted to announce the addition to the team of three of the sharpest minds in sports business across the globe. One of Australia’s most experienced and respected sport business leaders, David Gallop AM, is joining alacria as Chairman and will provide his oversight, knowledge and experience to the company’s clients globally. As CEO, David led two of Australia’s largest sports, the National Rugby League and Football Australia, as well as being Deputy Chair of the Australian Sports Commission, Chair of the Coalition of Major Professional and Participation Sports and a director of the AFC Asian Cup 2015 Local Organising Committee. Also a former executive at News Corp, he is currently a non-executive director of ASX listed Tabcorp and Cricket NSW. “We are really pleased to have David join the team. Having worked with him at Football Australia, I have seen first-hand his outstanding leadership, strategic thinking and commercial knowledge...

Read More

February 19, 2021

With thanks to Emerging Cricket, Luke Bould discusses plans for the emergence of cricket in America with USA Cricket’s CEO Iain Higgins and Development Manager Jamie Lloyd. The Entry Level Program (ELP) for youth Announcing progress on a new entry level youth program exclusively to Emerging Cricket, USA Cricket CEO, Iain Higgins, said ‘The design and delivery of a fun and engaging entry level program (ELP) for girls and boys is absolutely critical to our vision of establishing cricket as a leading sport in the USA. We are delighted to partner with alacria in the development of this program. They have a proven track record both in cricket as well as in the introduction of new sports into non-traditional markets, and have leveraged US research and local community expertise to ensure that this ELP will be effective in driving participation in the USA market.’ alacria brings decades of combined experience working particularly in the development of sports participation programs. The leadership team at alacria have worked with Cricket Australia, BCCI, ECB, South African Cricket, New Zealand Cricket, Cricket Ireland, and that’s just the cricket section of their CV! Check out the full story here

Read More

February 19, 2021

As the next step in USA Cricket’s Foundational Plan, the National Governing Body has today announced the appointment of Alacria to develop the curriculum, marketing and commercialization model of the organisation’s new Entry Level Program for participation that will commence roll-out in the United States in the second half of 2021. Work to establish the program, which will be the first experience of the game for many American children, is an important initiative to introduce the game to young American girls and boys, as USA Cricket seeks to achieve their long term vision of establishing cricket as a leading sport in the USA. The program will be designed to provide a fun and engaging first experience of the game with a view to creating interest and understanding in cricket among school students across America. In addition USA Cricket is committed to contributing to the nationwide push to get kids more active and playing more sport. Alacria is an experienced consultancy that works with businesses around the world on the development of strategies to attract, retain and grow the value of their participants. With a foundation in sports, Alacria’s leadership have worked on many entry level programs across the world and...

Read More

February 18, 2021

AJ Maetas, the founder of leading US based sports insights Navigate, hosts Luke Bould for a discussion on the sports industries in the US and Australia. The Podcast explores the challenges and opportunities of growing sports participation, the learnings from the establishment of new properties such as the Big Bash, the future of sports content delivery and alacria’s approach to establishing new sports in non-traditional markets such as cricket in the US. Available on all major podcast platforms including Apple Podcasts

Read More